2025 Tax Brackets Usa Income Unbelievable. To figure out your tax bracket, first look at the rates for the filing status you plan to use: Discover the updated tax rate 2025 tables and key thresholds for a clearer understanding of the internal revenue code.

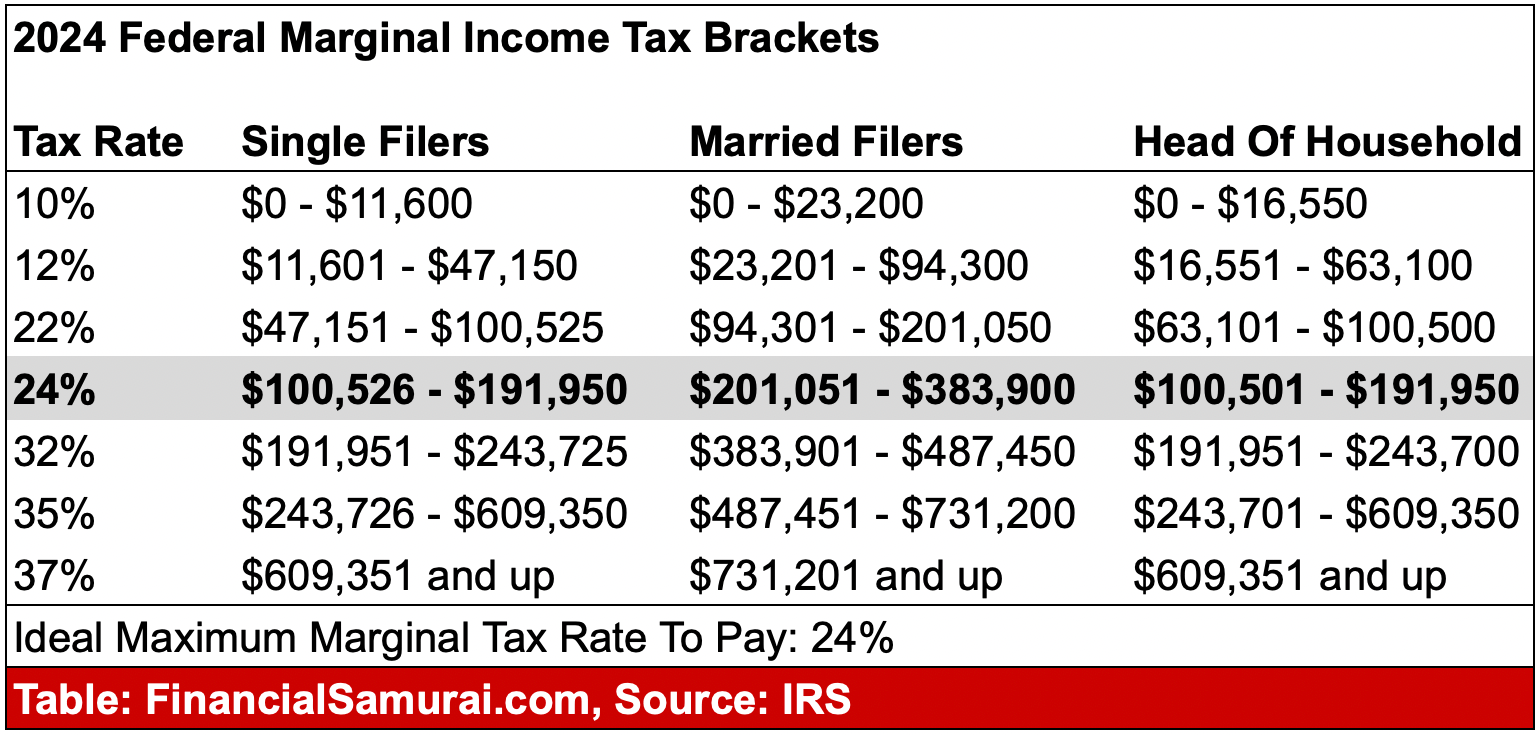

The federal income tax has seven tax rates in 2025: For tax year 2025, which applies to taxes filed in 2026, there are seven federal tax brackets with income tax rates of 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Compare your take home after tax an.

Source: jaspermonroe.pages.dev

Source: jaspermonroe.pages.dev

2025 Us Tax Brackets Single Jasper Monroe Single, married filing jointly, married filing. 2025 us tax tables with 2025 federal income tax rates, medicare rate, fica and supporting tax and withholdings calculator.

Source: adriandbaughman.pages.dev

Source: adriandbaughman.pages.dev

Usa 2025 Tax Brackets Adrian D. Baughman Discover the updated tax rate 2025 tables and key thresholds for a clearer understanding of the internal revenue code. For tax year 2025, which applies to taxes filed in 2026, there are seven federal tax brackets with income tax rates of 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Source: michellesbutler.pages.dev

Source: michellesbutler.pages.dev

What Are The Tax Brackets For 2025 Michelle S. Butler In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate).

Source: mechellempedersen.pages.dev

Source: mechellempedersen.pages.dev

2025 US Tax Brackets A Comprehensive Guide Mechelle M. Pedersen The federal income tax has seven tax rates in 2025: In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Source: dennismfuchs.pages.dev

Source: dennismfuchs.pages.dev

Tax Brackets For 2025 Tax Year Calculator Dennis M. Fuchs Compare your take home after tax an. The federal income tax has seven tax rates in 2025:

Source: ceilhjktrescha.pages.dev

Source: ceilhjktrescha.pages.dev

Tax Brackets For 2025 Tax Year Usa Paola Annamarie To figure out your tax bracket, first look at the rates for the filing status you plan to use: In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Source: katiehillj.pages.dev

Source: katiehillj.pages.dev

Tax Brackets 202525 Katie J. Hill For tax year 2025, which applies to taxes filed in 2026, there are seven federal tax brackets with income tax rates of 10%, 12%, 22%, 24%, 32%, 35%, and 37%. The federal income tax has seven tax rates in 2025:

Source: meivanjonge.pages.dev

Source: meivanjonge.pages.dev

Tax Brackets For 2025 Tax Year Usa Images References Mei For tax year 2025, which applies to taxes filed in 2026, there are seven federal tax brackets with income tax rates of 10%, 12%, 22%, 24%, 32%, 35%, and 37%. There are seven (7) tax rates in 2025.

Source: katiehillj.pages.dev

Source: katiehillj.pages.dev

Tax Brackets 202525 Katie J. Hill To figure out your tax bracket, first look at the rates for the filing status you plan to use: For single taxpayers and married individuals filing separately for tax year 2025, the standard deduction rises to $15,000 for 2025, an.

Source: dennismfuchs.pages.dev

Source: dennismfuchs.pages.dev

Tax Brackets For 2025 Tax Year Calculator Dennis M. Fuchs Compare your take home after tax an. In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

Source: meivanjonge.pages.dev

Source: meivanjonge.pages.dev

Tax Brackets For 2025 Tax Year Usa Images References Mei 2025 us tax tables with 2025 federal income tax rates, medicare rate, fica and supporting tax and withholdings calculator. The federal income tax has seven tax rates in 2025:

Source: palomagrace.pages.dev

Source: palomagrace.pages.dev

Irs Announces New Tax Brackets For 2025 Paloma Grace For single taxpayers and married individuals filing separately for tax year 2025, the standard deduction rises to $15,000 for 2025, an. For tax year 2025, which applies to taxes filed in 2026, there are seven federal tax brackets with income tax rates of 10%, 12%, 22%, 24%, 32%, 35%, and 37%.